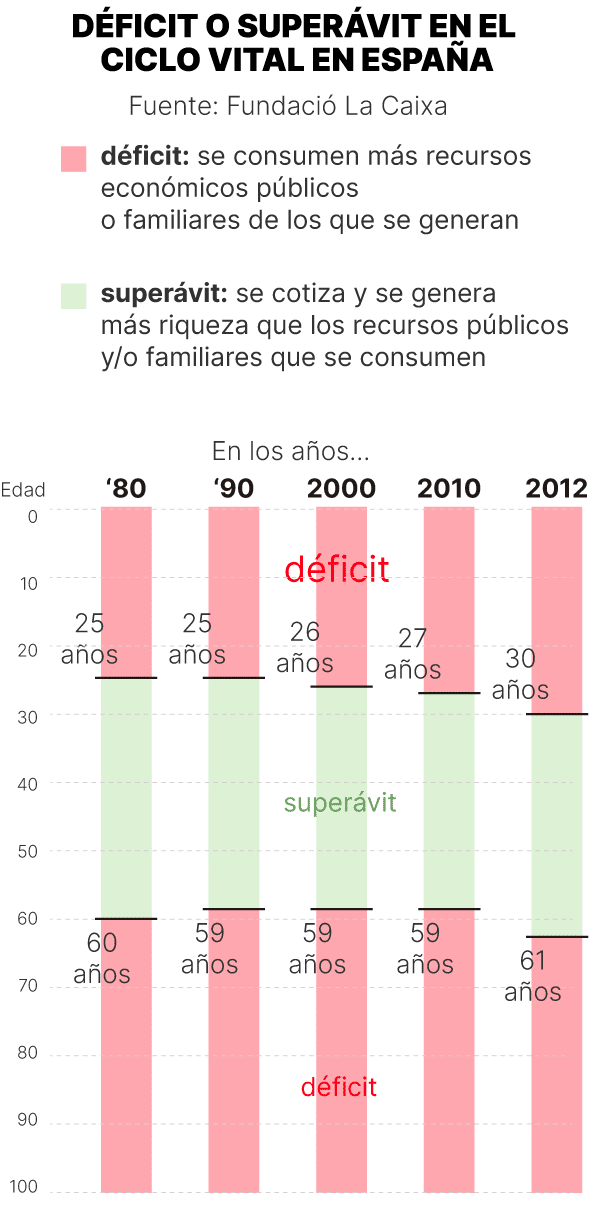

There are three moments in people’s lives. From the intergenerational economics perspective there is a stage in which people obtain sufficient income to cover all their spending needs and, even more, to pay taxes and contributions with which to finance the needs of the welfare state. This is a time that in Spain, in aggregate terms, could be placed at the point between 27 and 59 years of age (with data from 2010). This is the position of the report ‘La equidad entre generaciones como garantía del bienestar social’ (Intergenerational equity as a guarantee of social welfare), published in the dossier ‘Estado del bienestar, ciclo vital y demografía’ (Welfare state, life cycle and demographics) by Fundación La Caixa and coordinated by the professor Concepció Patxot from the University of Barcelona.

A similar life-cycle deficit situation is identified after the age of 59: the consumption needs of the elderly are mostly financed by public pensions and, where appropriate, by the contributions of the families themselves.

The life cycle of expenditure

Two stages of life cycle deficit and, in between, like a sandwich, a period of surplus. The sandwich is repeated in all developed societies, as reflected in the research project ‘Aging Europe. National Transfer Accounts in Europe’ (AGENTA), which includes the report signed by Patxot and the academics Gemma Abio, Elisenda Rentería, Meritxell Solé y Guadalupe Souto. The difference between the two societies lies in the more or less extensive duration of the central moment and in how the other two stages are financed.

In Spain, public money transfers in favor of the elderly (pensions, above all) are 33 times higher than spending on families and young people (9.8% of GDP in the first case compared to 0.3% in the second, according to Eurostat data). Moreover, the weight of old-age benefits in relation to GDP has increased three points in Spain since 2008, while that of family benefits has remained unchanged.

For the full article, please visit Diario de Ibiza website here.